- February 28, 2025

Welcome

Contact information

- Schedule a Call

- books@greenhazel.co

- 2340 Texas Heritage Parkway Katy, TX 77494

Subscribe to our newsletter

Contact us for your Bookkeeping

Contact UsUnderstanding Spa-Specific Financial Statements: What Every Owner Should Know

- Home

- Understanding Spa-Specific Financial Statements: What Every Owner Should Know

-

- By: admin

- September 21, 2024

As a spa owner, understanding your financial statements isn’t just an administrative task, it’s a critical aspect of managing and growing your business. Whether you offer massage therapy, nail care, esthetician services, or a combination of spa treatments, staying on top of your finances helps you make smarter decisions, maintain profitability, and plan for the future. In this blog, we’ll break down spa-specific financial statements, explaining what each key report entails and how you can use this information to your advantage.

Why Financial Statements Matter for Spa Owners

Before diving into the details, it’s important to understand why financial statements are so crucial for spa owners. Properly maintained financial reports provide:

- A clear picture of your spa’s financial health, whether you’re operating in the green or red.

- Insights into cash flow, enabling better budgeting and expense management.

- Data to help you identify which services are most profitable.

- Information that is essential for filing taxes and applying for business loans or financing.

Let’s explore the three most important financial statements every spa owner should know: the profit and loss statement, the balance sheet, and the cash flow statement.

- Profit and Loss Statement (P&L): Measuring Your Spa’s Profitability

Also known as the income statement, the P&L report is one of the most important financial documents for your spa. It summarizes the revenues, costs, and expenses incurred during a specific period, typically quarterly or annually, to show whether your spa is making a profit or operating at a loss.

Key Sections of a P&L Statement:

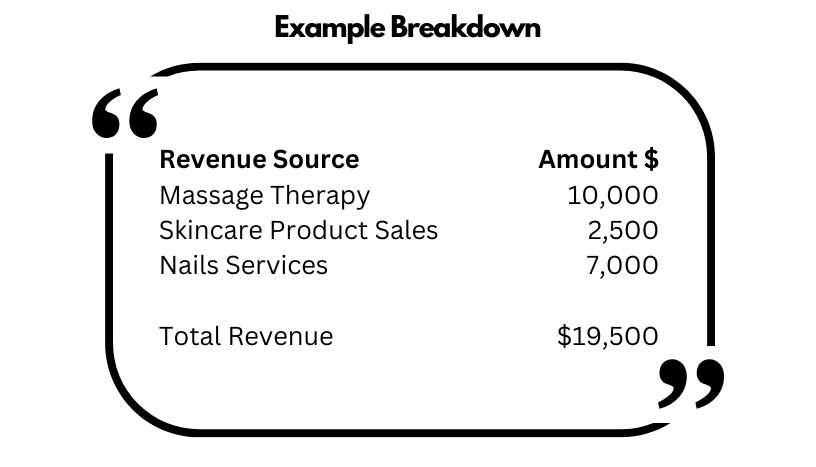

- Revenue (Income): This includes all sources of income for your spa—whether it’s from massage services, nail care, or retail product sales like skincare lines. For example, a massage therapist may bring in revenue from single sessions and membership plans, both of which should be clearly documented.

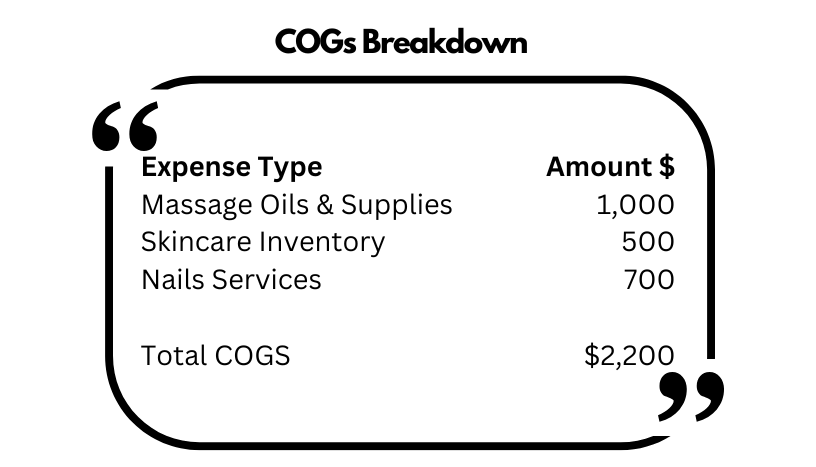

- Cost of Goods Sold (COGS): This category covers the direct costs associated with providing services. For spas, this could include massage oils, skincare products, or nail supplies. Accurately tracking COGS helps determine the true profitability of each service.

- Operating Expenses: These are the ongoing costs necessary to run your business. Examples include rent, utilities, payroll for massage therapists, and marketing expenses.

- Gross Profit: Calculated by subtracting COGS from total revenue, this figure shows the profitability of your core services before other expenses are accounted for.

- Net Profit: This is your bottom line—total revenue minus all costs and expenses, including payroll and overhead.

Pro tip: Review your P&L statement regularly to identify which services (e.g., facials vs. manicures) are driving the most profit, allowing you to focus marketing and resources where it counts.

- Balance Sheet: Understanding Your Spa’s Financial Position

A balance sheet provides a snapshot of your spa’s financial position at a specific point in time. It outlines your assets, liabilities, and owner’s equity, giving you a clear understanding of what your spa owns and owes.

Key Components of a Balance Sheet:

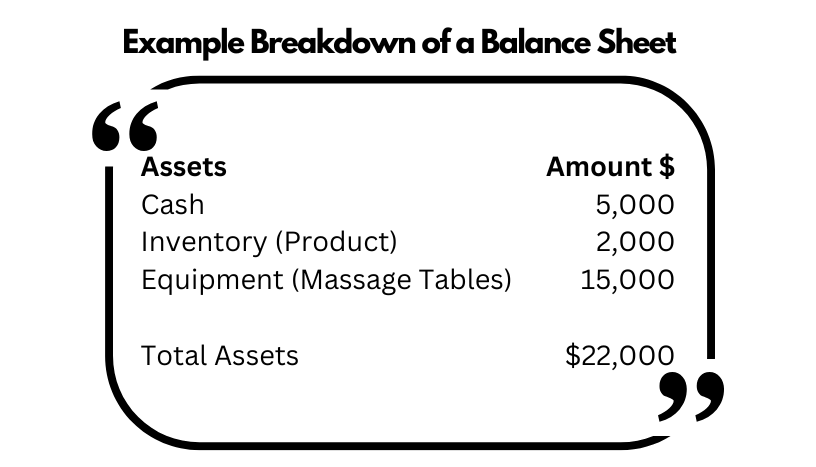

- Assets: These are the things your spa owns. They are typically divided into current assets (cash, inventory, accounts receivable) and long-term assets (equipment, spa furniture, property). For example, your massage tables, nail stations, and product inventory are all considered assets.

- Liabilities: This is what your spa owes. Current liabilities include debts that need to be paid within a year, such as supplier invoices or short-term loans. Long-term liabilities could include any business loans or leases on equipment.

- Owner’s Equity: The residual interest in the assets of the business after liabilities are deducted. In simpler terms, this is your ownership stake in the spa.

Pro tip: Your balance sheet should always balance, meaning the total assets must equal the sum of liabilities and owner’s equity. Regularly reviewing this report helps ensure you’re not over-leveraging your spa’s financial position.

- Cash Flow Statement: Managing Your Spa’s Cash Flow

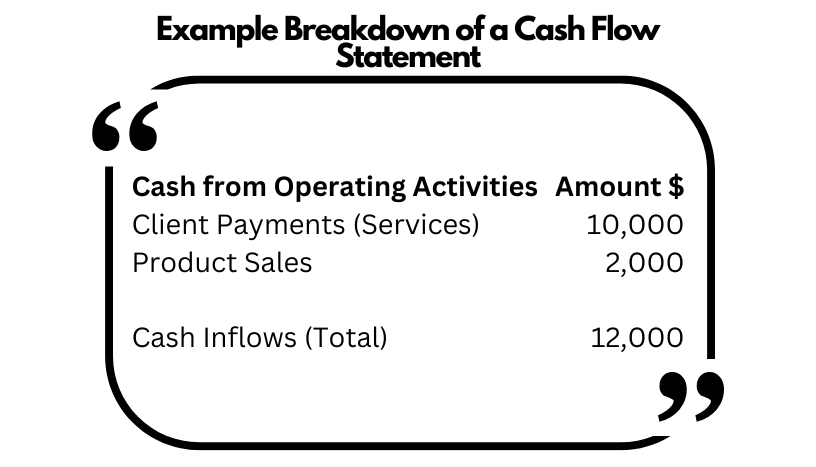

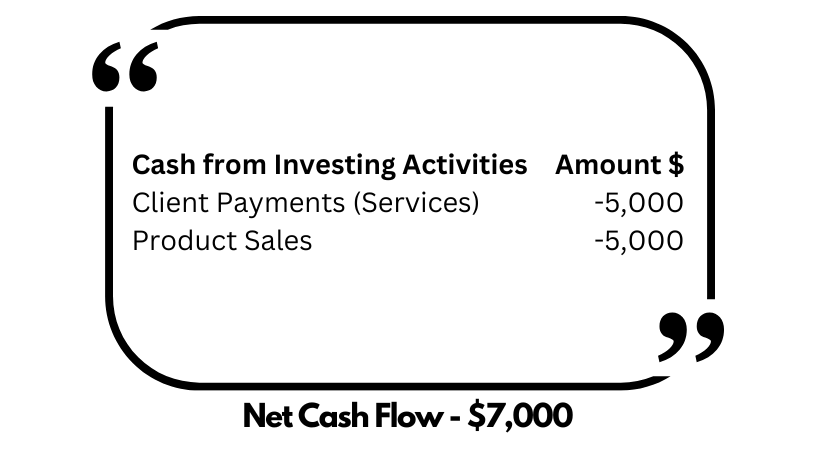

Cash flow is the lifeblood of any business, and spas are no different. A cash flow statement tracks the flow of money into and out of your spa over a specific period. It’s divided into three sections: operating activities, investing activities, and financing activities.

Key Sections of a Cash Flow Statement:

- Operating Activities: This section includes the cash generated from your day-to-day services. For instance, cash payments from clients for massage services, yoga classes, or facial treatments fall under this category.

- Investing Activities: This includes cash used for purchasing long-term assets like spa equipment or upgrades to your facility.

- Financing Activities: These activities include transactions related to financing your business, such as loan repayments or cash injections from investors.

Pro tip: Keep an eye on your cash flow statement to avoid liquidity issues. If cash outflows regularly exceed inflows, it may indicate an unsustainable business model, even if your profit and loss statement looks strong.

How to Use Financial Statements to Improve Your Spa’s Performance

- Identify Profit Margins

By comparing your revenue to the cost of goods sold on your P&L statement, you can identify which services are the most profitable. For example, if manicures have a higher profit margin than facials, you might want to promote that service more aggressively. - Monitor Cash Flow Regularly

Avoid liquidity issues by ensuring that you have enough cash on hand to cover both operating expenses and unexpected costs. Review your cash flow statement regularly to ensure you’re not spending more than you’re bringing in. - Track Asset Value and Debt Levels

Your balance sheet provides an overview of your financial health. Make sure to monitor your debt levels, especially if you’re considering taking out loans for expansion or equipment upgrades.

Takeaway: Master Your Spa’s Financials to Drive Growth

Understanding and leveraging your spa’s financial statements can mean the difference between success and failure. By regularly reviewing your P&L, balance sheet, and cash flow statement, you’ll gain insights that will help you run a more profitable and sustainable business. Financial clarity is key to scaling your spa, optimizing service offerings, and managing costs effectively.

Need help managing your spa’s financial statements? Contact us today to learn how our bookkeeping services can ensure you stay on top of your financial health!

Categories

Latest posts

- February 24, 2025

Best Practices for 1099 Record-Keeping

- February 19, 2025